Whether we need trash can liners and cleaning supplies, or something more personal like beauty supplies, vitamins, or a gym membership, much of what we order these days is through a subscription.

Consumers widely accept (and even expect) to order items on a subscription basis. As a result, business owners should be ready to meet that expectation by providing a flexible, hassle-free subscription payment method.

Jotform’s PayPal Business integration now offers a subscription payment option, which makes collecting subscriptions through your forms a snap.

Let’s face it; your time is valuable. You need a workflow automation solution that can handle a subscription based service offering in addition to your regular data-collection and management tasks.

How to add subscription payments to your order forms

To add subscription payments, create an order form by customizing one of our templates or by putting one together from scratch.

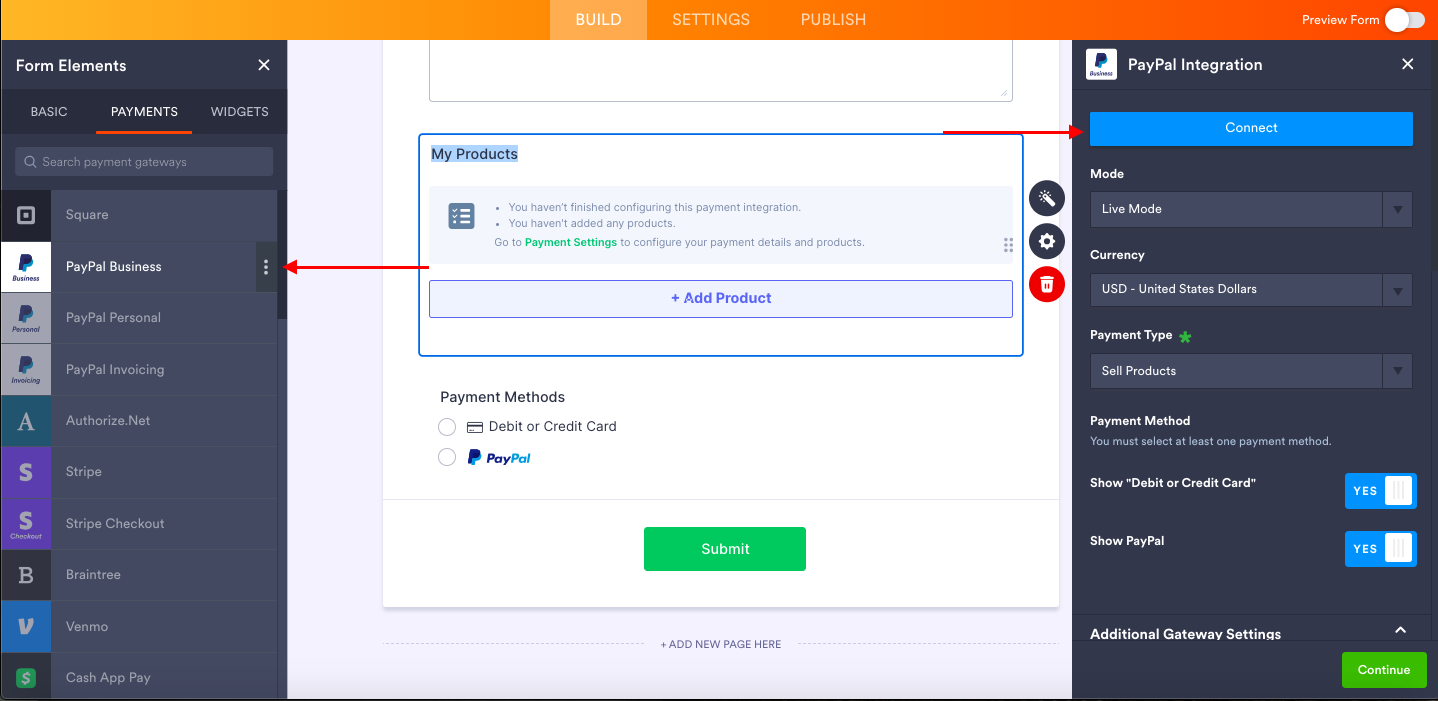

For instance, I’ve created an order form for my fictitious bagel business. In the Build tab of the Form Builder, I’ve added PayPal Business from the Payments tab in Form Elements.

You’ll see the PayPal Business integration settings in a panel on the right of the screen. Click the Connect button to authenticate your PayPal account.

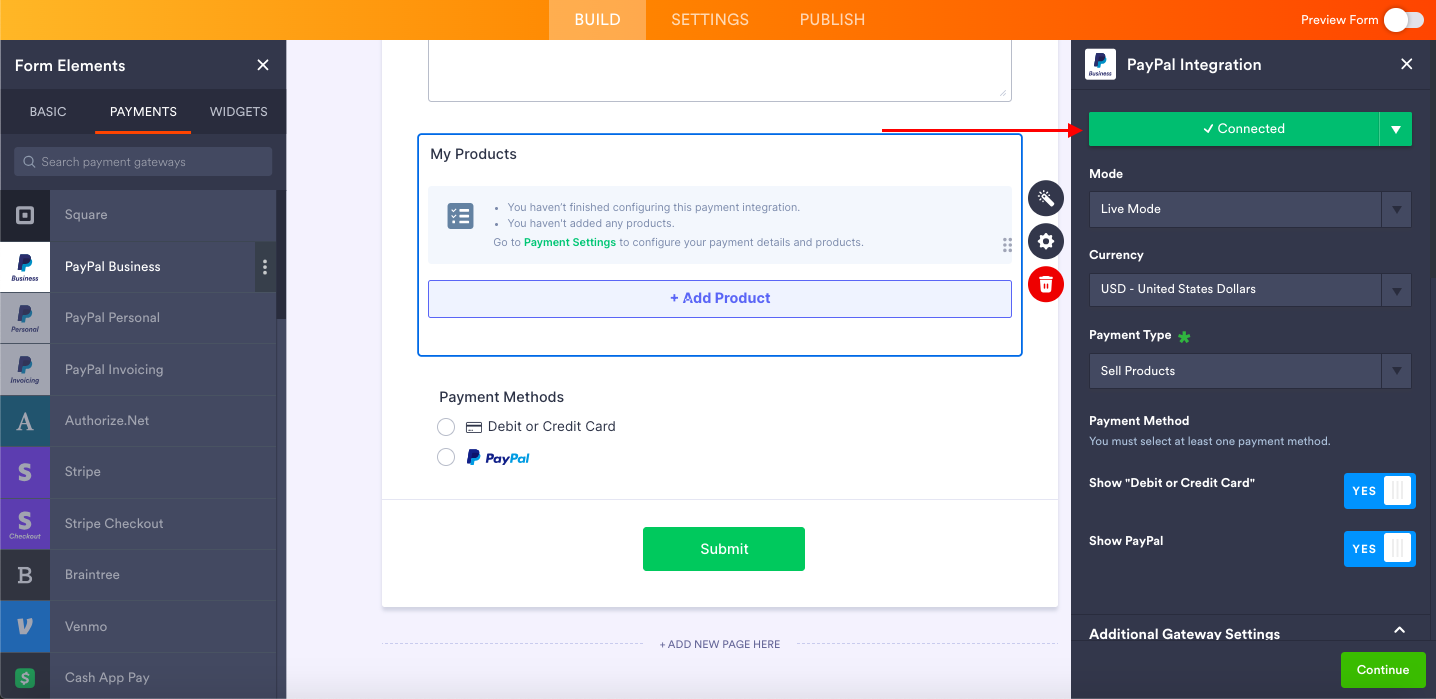

From there you’ll be prompted to either create an account or log into your existing PayPal account. I’ve logged in, and the integration shows that I’m now connected.

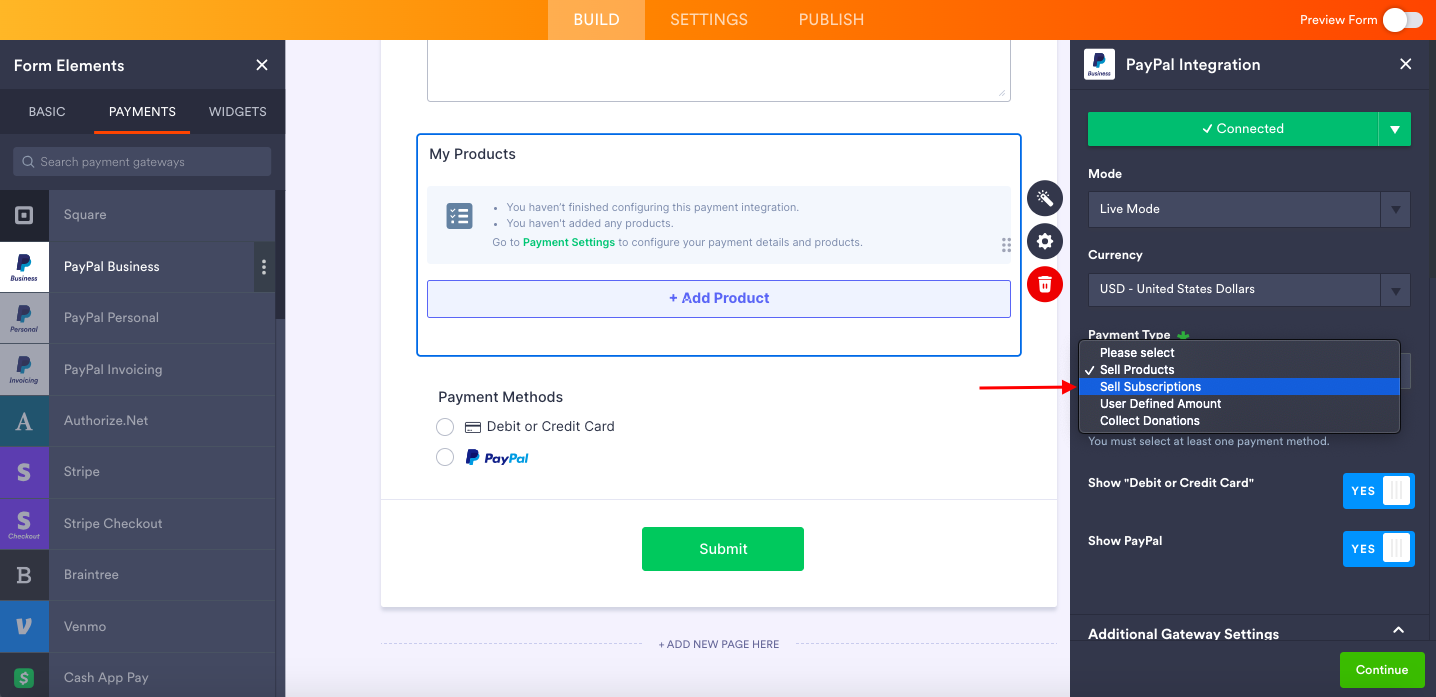

Click the Payment Type dropdown and select Sell Subscriptions.

At that point you’ll see a confirmation message asking you to verify that you want to sell subscriptions. (Selecting this option will make direct credit card payments and other payment types unavailable on the form itself.) Click Yes.

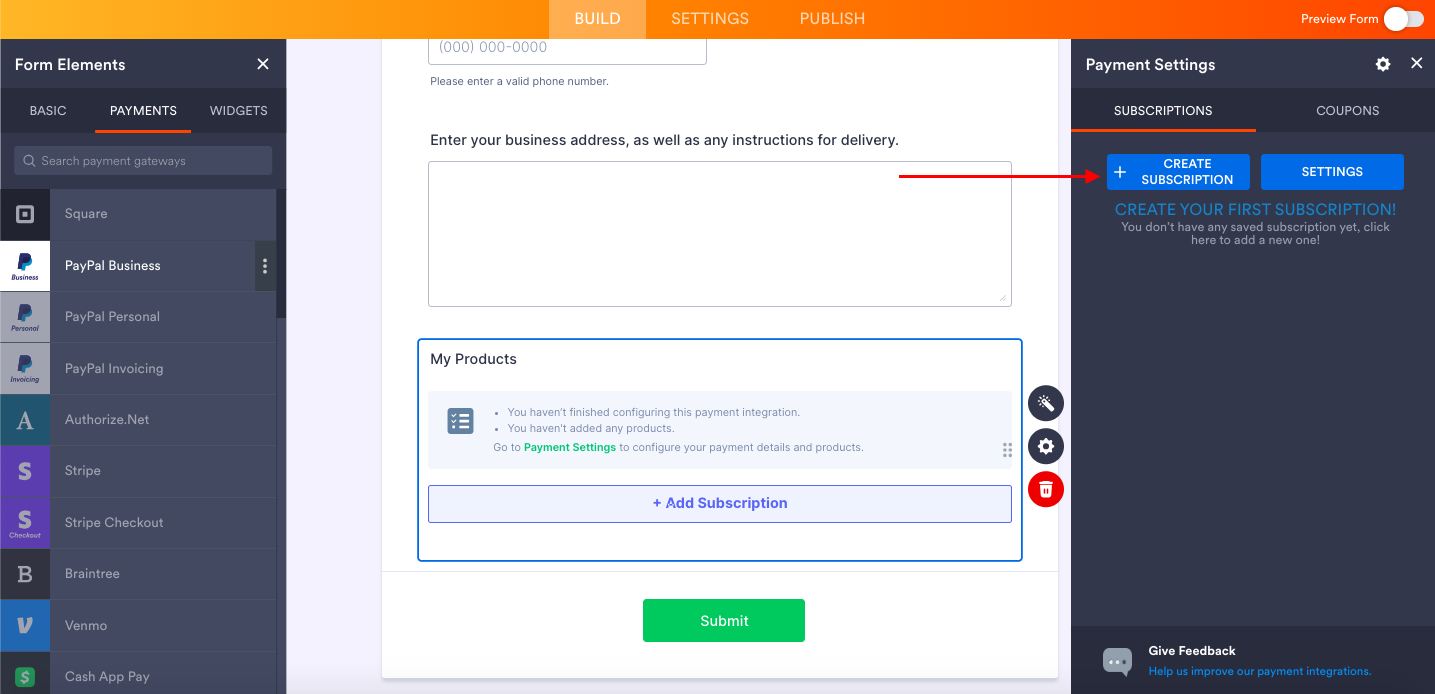

In the Payment Settings you’ll now see a Create Subscription button.

Pro Tip

If your form includes the Product List form element, it may be easier to create a new form for dedicated subscription sales as the Product List can’t currently handle subscriptions. However, it is technically possible to update your existing order form by adding a new standalone subscription item.

Setting up your subscription

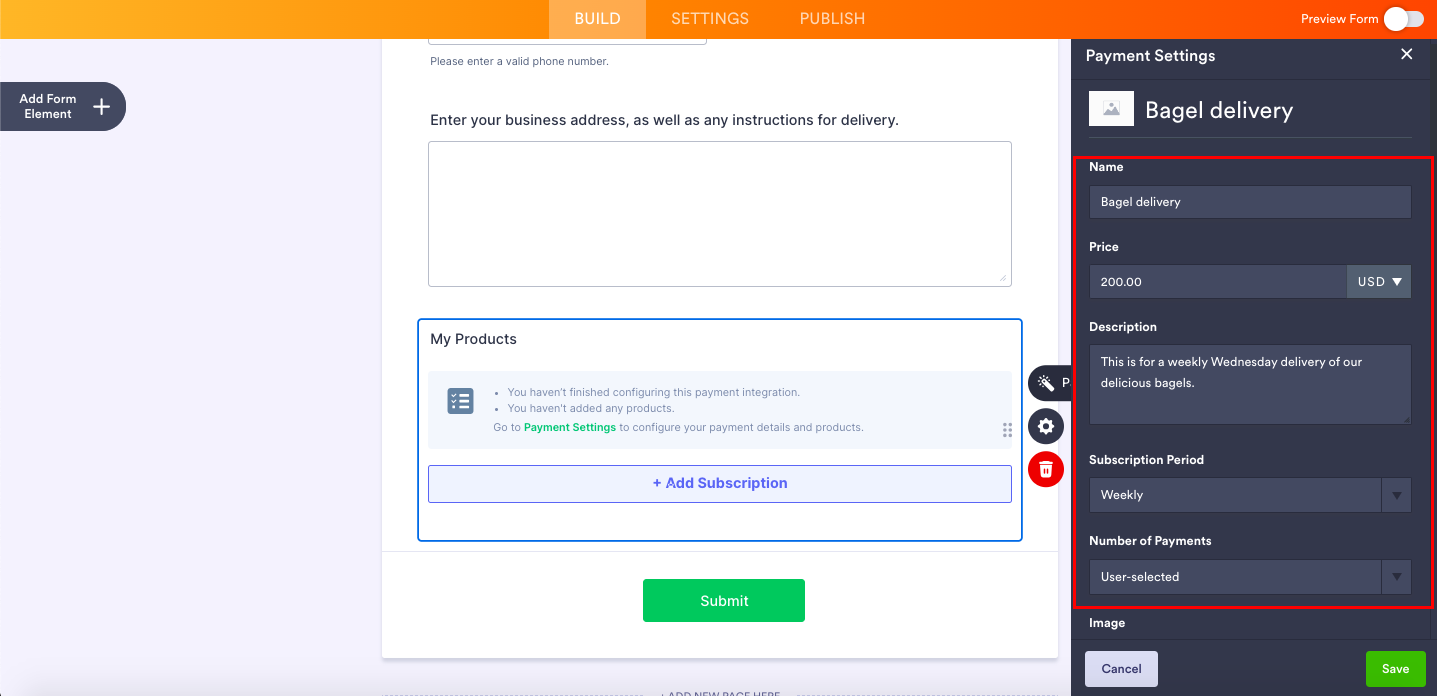

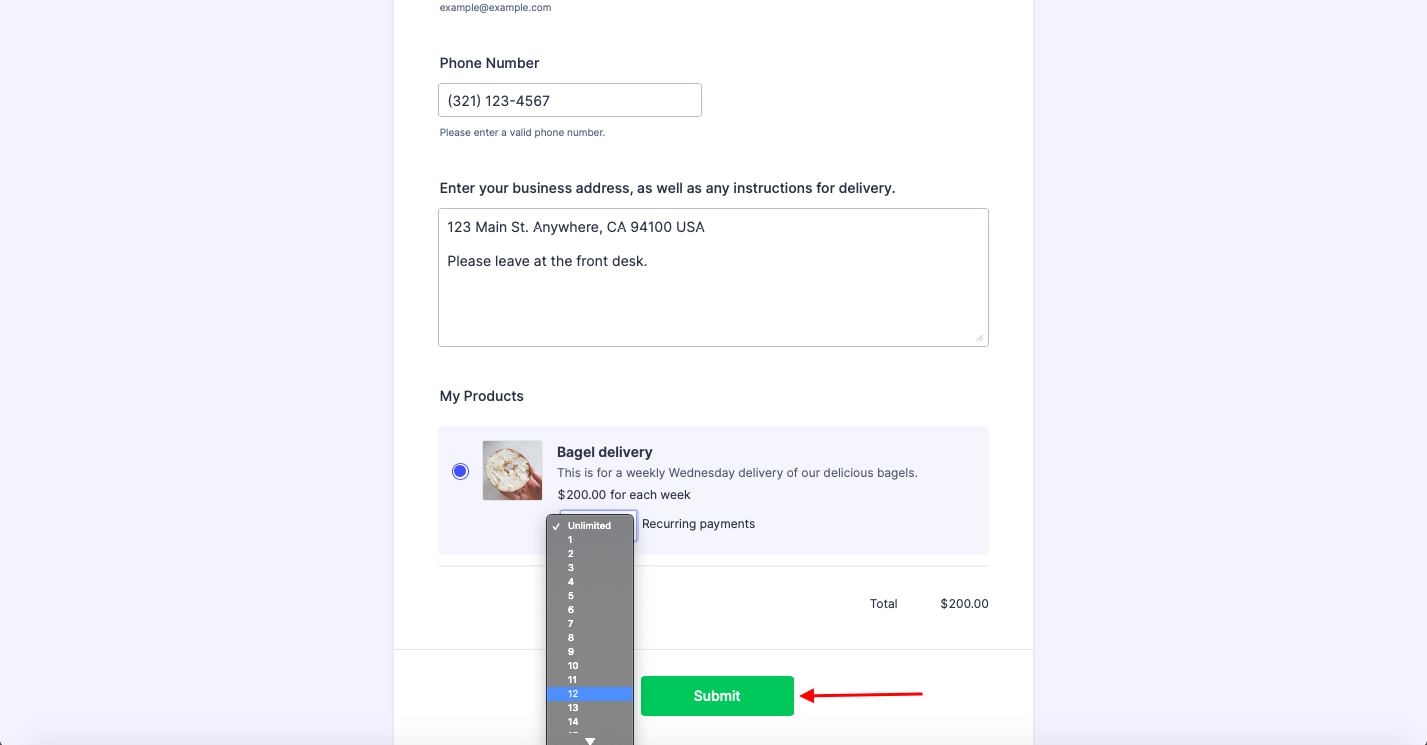

Upon creating your subscription, you’ll have options in the Payment Settings to create a name, set a price, and select your subscription period and the number of payments (including a User-selected option for customer flexibility).

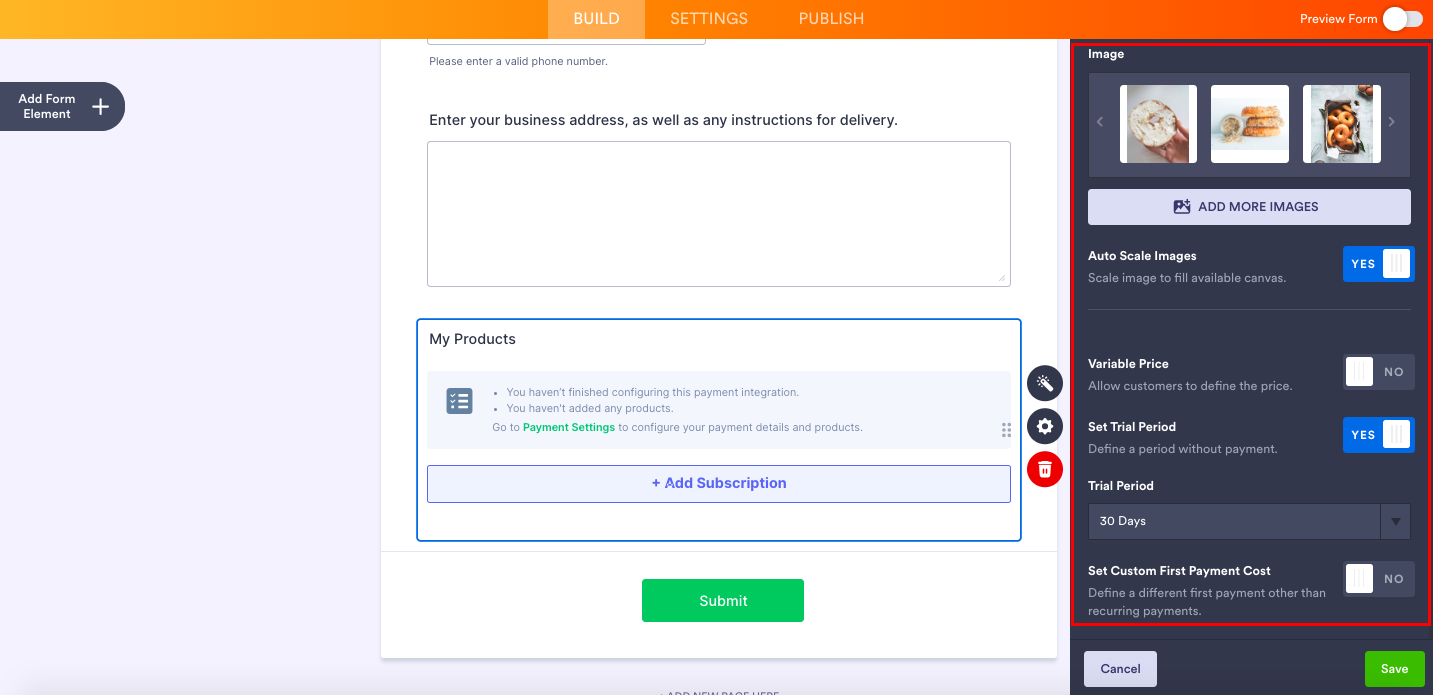

Here you can add photos of your product and, importantly, set a free trial period by choosing one of several options, from one day up to one year.

Or, if you want to charge your customer a lower/higher first payment (than the subsequent recurring payments), you can do so. Selecting this option will also allow you to adjust the first payment period time frame.

When you’re done, click the Save button.

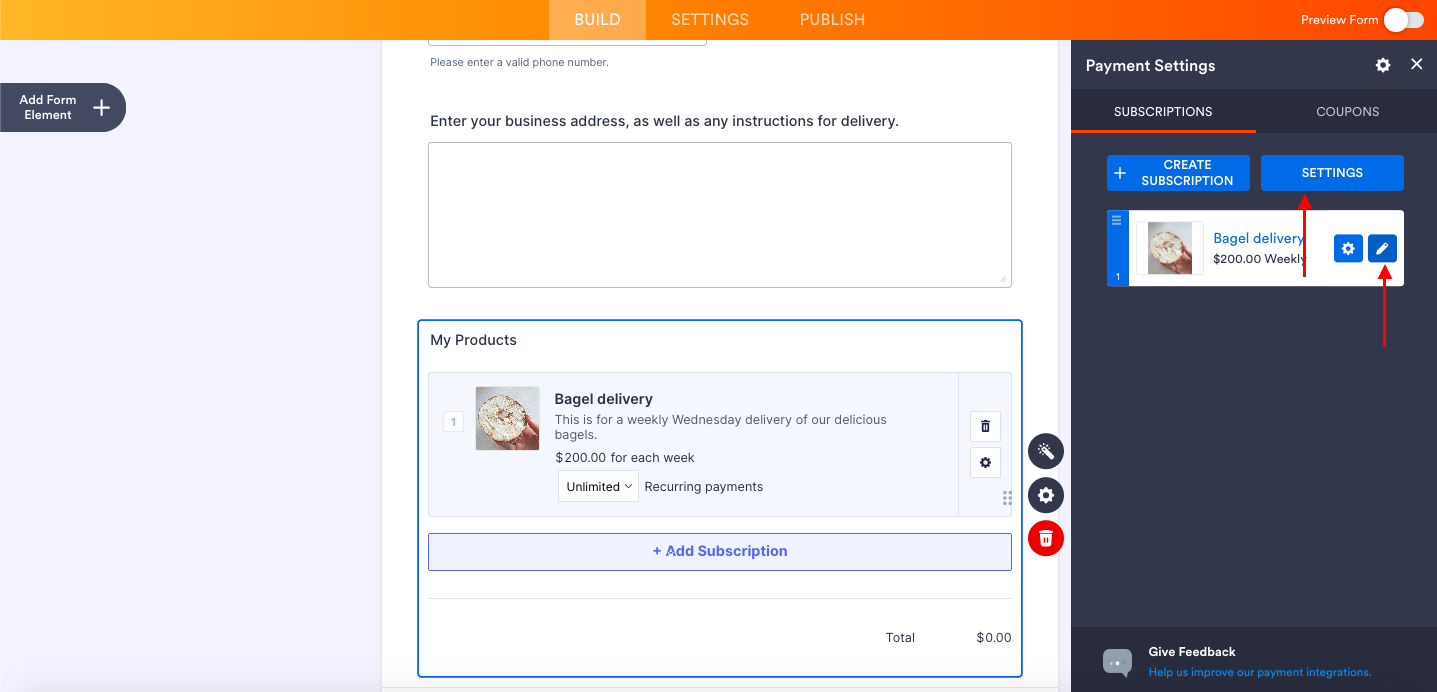

You’ll notice your subscription offering now appears on your form and in the Payment Settings. If you need to make changes, click the pencil icon to edit your subscription item.

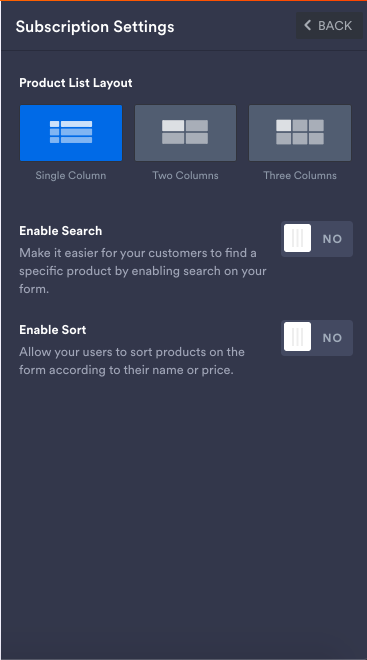

Clicking the Settings button enables you to change the layout of your products. This comes in handy for organizing a large number of products on your form. You can also enable search and sort, making it easier for your users to find products within your form.

Back in the Payment Settings, you can create a coupon code and use it to apply a percentage or fixed amount discount to one product or multiple products.

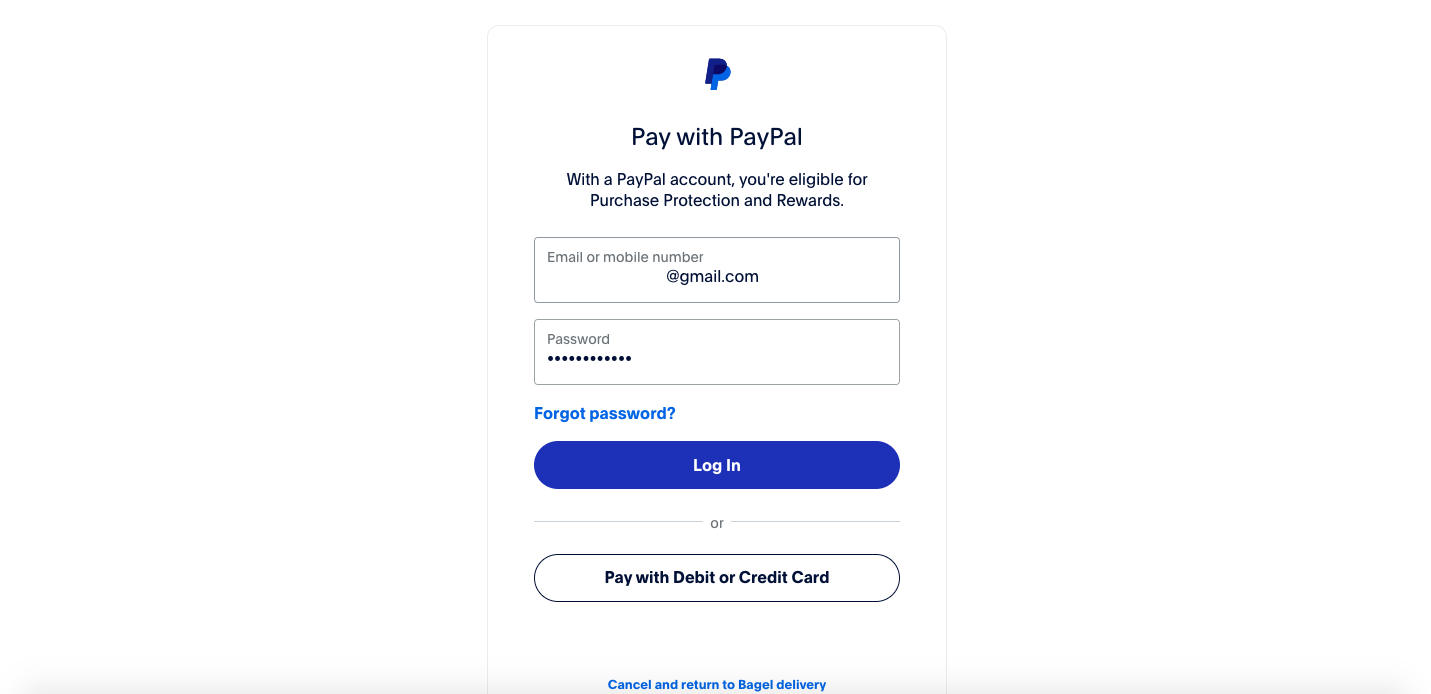

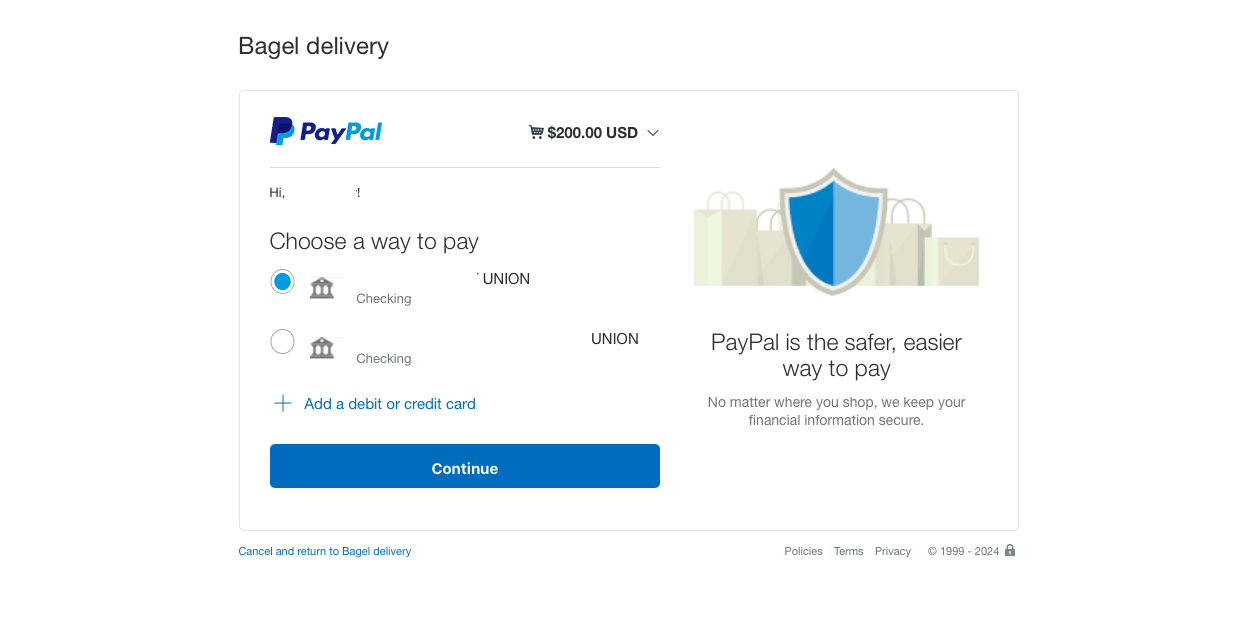

Once a customer clicks the Submit button on my form, the screen will automatically redirect them to log into PayPal.

This way, the customer can confirm the subscription payment arrangements via whichever method they choose (or is available) in their account.

PayPal’s subscription option helps you deliver a great customer experience

Simply put, the more payment options you offer your customers, the wider your net to catch more sales.

Subscription-based payments offer your customers the convenience of “set it and forget it,” knowing they’ll have the supplies or services they need on a regular basis (particularly for service oriented offerings).

On the flipside, subscriptions benefit merchants by offering a steady stream of orders from a single purchaser. They also encourage customer retention.

In fact, Recurly’s 2024 State of Subscriptions study put the median customer retention rate at approximately 96 percent across all subscription industry types.

In the world of online and alternative payment methods, there’s no bigger name than PayPal. Its brand recognition helps give customers the confidence to buy. The all-in-one PayPal Checkout solution with Jotform offers PayPal, Venmo, Pay Later, credit card processing, and now subscriptions.

Additionally, PayPal boasts a 95 percent checkout completion rate for credit and debit card payments1, and a 46 percent higher than average checkout conversion rate.2

That’s why we’re excited that you can now offer a subscription option in your forms, courtesy of the PayPal Business integration with Jotform.

***

If you’re curious how PayPal Business compares to PayPal Personal, here’s a quick primer.

| Which PayPal payment integration best serves your form needs? | ||

|---|---|---|

| PayPal Business | PayPal Personal | |

| Best for | Merchants or small businesses that need a flexible, affordable payment solution | Individuals who use peer-to-peer payments and/or casually market their goods and services |

| Subscription payment support | Yes | No |

| Supported payment methods | Invoicing, credit cards, digital wallets, installments, Venmo (U.S. only) | Bank account, PayPal Credit, debit or credit cards |

| Account sharing | Access for up to 200 employees, with custom access levels for every user | 1 user |

| In-store payments accepted? | Yes, collect and process payments in store via the PayPal Zettle POS | No |

| Costs/transaction fees at a glance (goods and services only) | 2.99% + $0.49 for credit/debit card, or PayPal balance online payments 4.49% (+ fixed fee based on currency) for international online payments *Fee structure can vary based on payment product, method, and country. |

2.90% + $0.30 for credit/debit card online payments 4.49% (+ fixed fee based on currency) for international online payments *Fee structure can vary based on payment product, method, and country. |

| Donation fees | 2.89% + $0.49 per transaction | 2.89% + $0.49 per transaction |

| Other features offered | PayPal credit or loans | Set up a QR code so buyers can conveniently scan your code in the app |

Still undecided? Check out our in-depth breakdown — PayPal business account vs personal account — to help you decide which is best for you.

Conclusion

We’re excited to offer what you need for a successful subscription technology stack. Now you can combine the capabilities of an integrated data management platform with the top alternative payment method subscription service in PayPal.

Our integration offers you flexible subscription options like

- Adjustable subscription period/intervals

- An adjustable number of payments

- A custom free trial period — from one day to one year

- A custom first payment cost and period

- Your own product list layout

- The ability to add coupon codes to your subscription

- The ability to add as many subscriptions to your form as you like

The success of your business (not to mention your subscriber life cycle) depends on the efficiency of your operation. Pairing a premier subscription solution with Jotform offers you best-in-class automation.

In case you’re wondering, this integration capability is free! All you’ll pay are the standard PayPal fees. There’s nothing extra and no charges from Jotform.

Adding PayPal Business for your subscription needs helps boost subscriber engagement and scale growth. You can relax, knowing the administrative concerns are taken care of.

Integrate PayPal Business today

1Based on PayPal internal data from 1st Jan 2022 – 31st Dec 2022.

2Nielsen Behavioral Panel of USA with 29K SMB monthly average desktop purchase transactions, from 13K consumers between April 2022-March 2023. Nielsen Attitudinal Survey of USA (June 2023) with 2,001 recent purchasers (past 4 weeks) from SMB merchants, including 1,000 PayPal transactions & 1,001 non-PayPal transactions.

Send Comment: