Steps to use Stripe for nonprofits

- Navigate to the Stripe website and click on the Start now button

- Select Nonprofit organization as your business type

- Input your nonprofit’s legal information

- Link your nonprofit’s bank account to your Stripe account

- Explore Stripe’s customization options

- Before launching your donation page, conduct test donations

- Embed Stripe’s payment buttons or widgets

- Use Jotform’s Stripe integration

- Bolster your fundraising efforts

It’s critical for nonprofit organizations to offer payment methods that are easy and convenient for their investors and donors to use. According to the Harvard Business Review, more than 97 percent of all money in circulation consists of funds deposited online, which means nonprofits today must employ tools that enable seamless online payments at any time, from anywhere.

Stripe is a payment platform that simplifies online transactions, minimizing engineering overhead and improving users’ front-end experience. But what makes Stripe for nonprofits so appealing? Read on for a breakdown of why Stripe works as a payment platform for nonprofits looking to improve their fundraising efforts — and how your organization can further enhance Stripe’s features by using Jotform.

Why Stripe for nonprofits works

Stripe’s user-friendly interface and comprehensive documentation make it easy for nonprofits to integrate digital payment processing into their websites.

Nonprofits often rely on recurring donations to sustain operations, so a simplified payment process that enables automated payments can provide a predictable stream of funding. Stripe also offers a wide array of payment methods — from credit and debit cards to mobile wallets — to accommodate donor payment preferences.

Stripe’s focus on data protection and secure transactions also fosters trust, encouraging donors to contribute without hesitation. For nonprofits with a global reach, Stripe’s international payment options make sure donors can contribute easily, no matter where they’re located. The platform allows donors to contribute in their local currencies, reducing friction and potential currency-conversion hurdles.

Jotform, a versatile form-building and data-collection solution, can further boost the benefits of Stripe for nonprofits. When you couple the payment portal with Jotform’s 100-plus donation form templates, the donation process can be a breeze for both nonprofits and their supporters. What’s more, using Jotform and Stripe in tandem allows nonprofits to create tailored donation forms that align with their branding, messaging, and specific organizational needs. These custom forms enhance the donor experience, which can lead to increased donations.

How to create a nonprofit account with Stripe

Wondering how exactly to use Stripe for nonprofits? Here’s a step-by-step guide on how to set up Stripe as a payment portal for nonprofits.

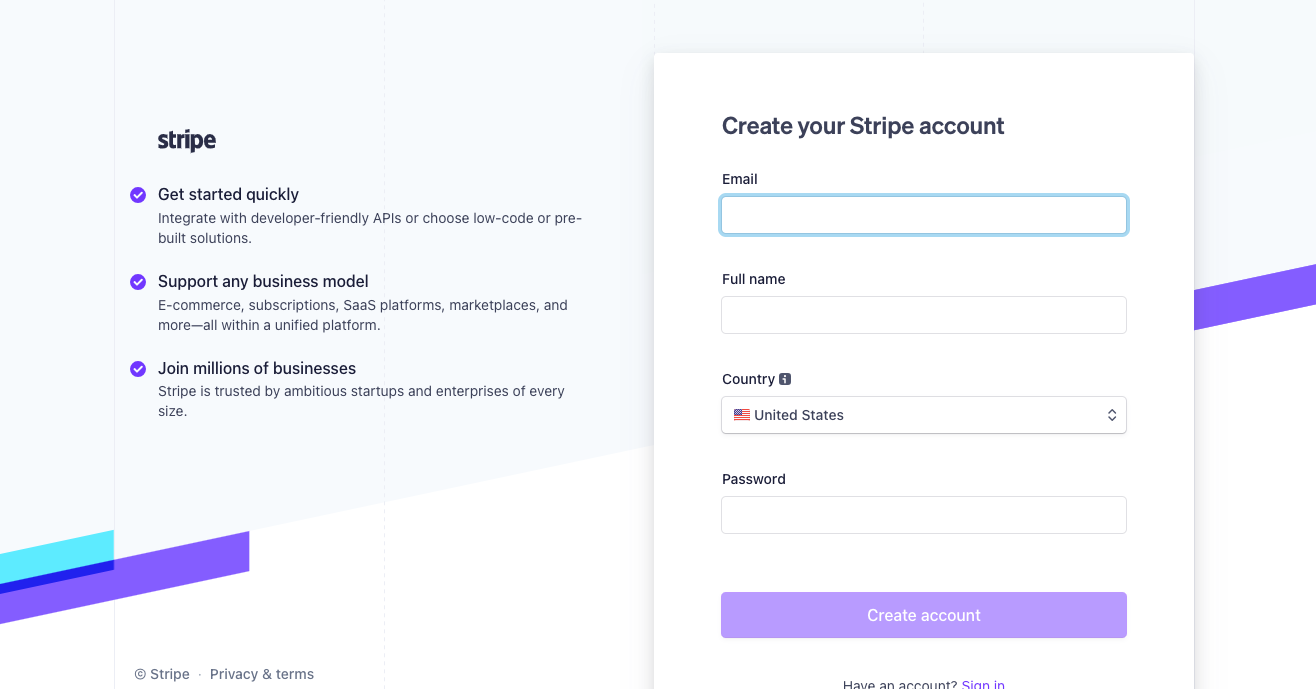

- Navigate to the Stripe website and click on the Start now button. Then, fill out each field to create your account.

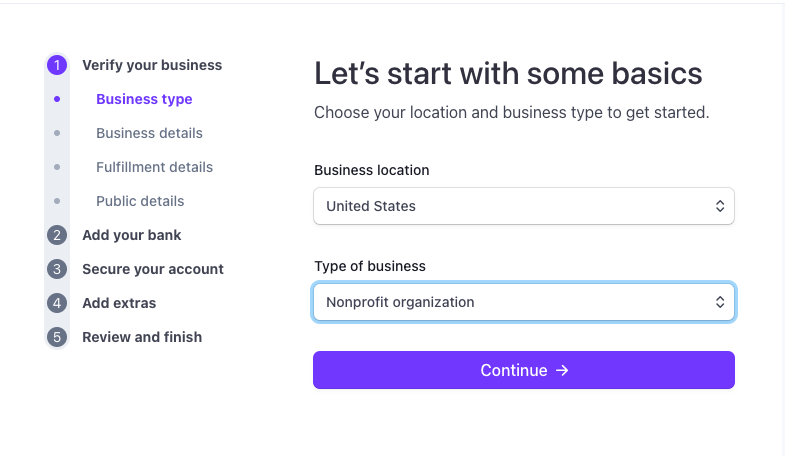

- Select Nonprofit organization as your business type. Fill in essential details about your organization, including its name, website, and mission.

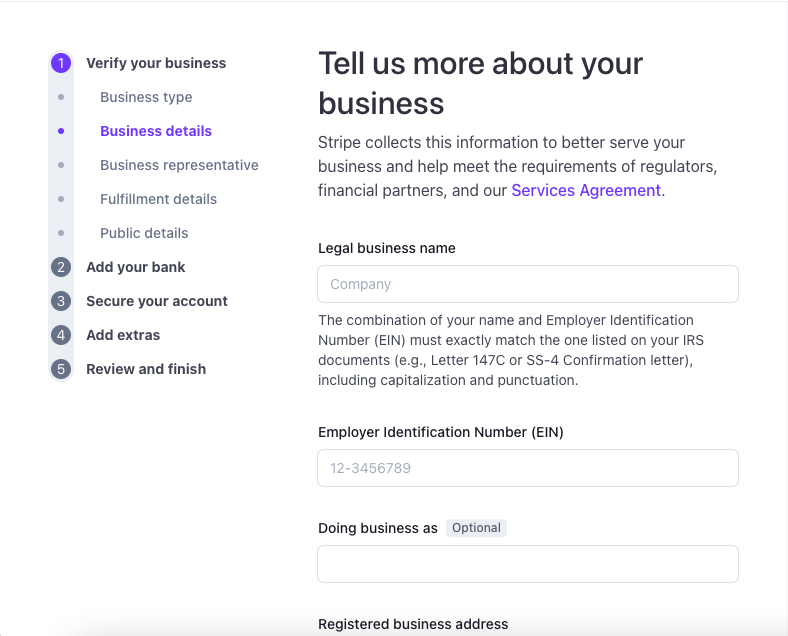

- Input your nonprofit’s legal information, including your employer identification number (EIN) or tax identification number. Stripe also encourages users to enable multiple methods of two-step authentication to keep their accounts secure.

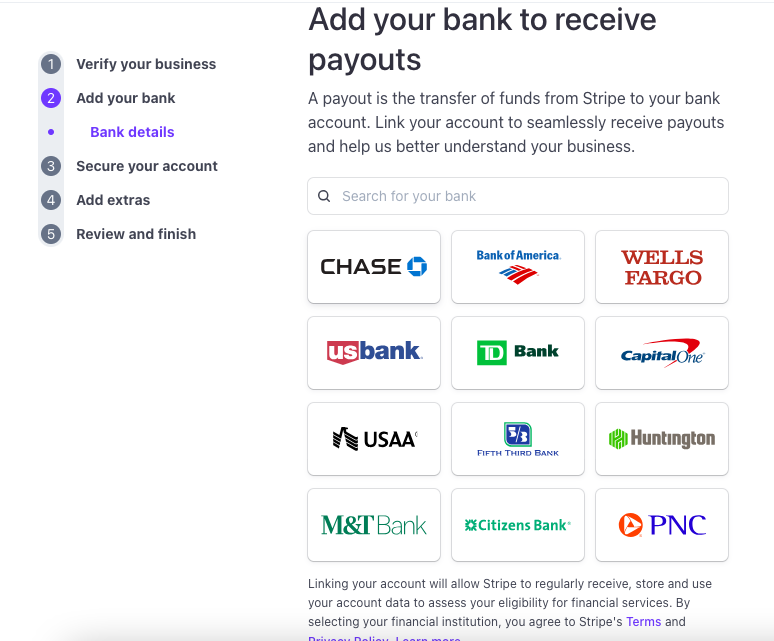

- To receive donations, link your nonprofit’s bank account to your Stripe account. Stripe will deposit small amounts into your account to verify that the connection is working. You can also configure your Stripe account settings for payment processing and choose your preferred currencies and accepted methods of payment.

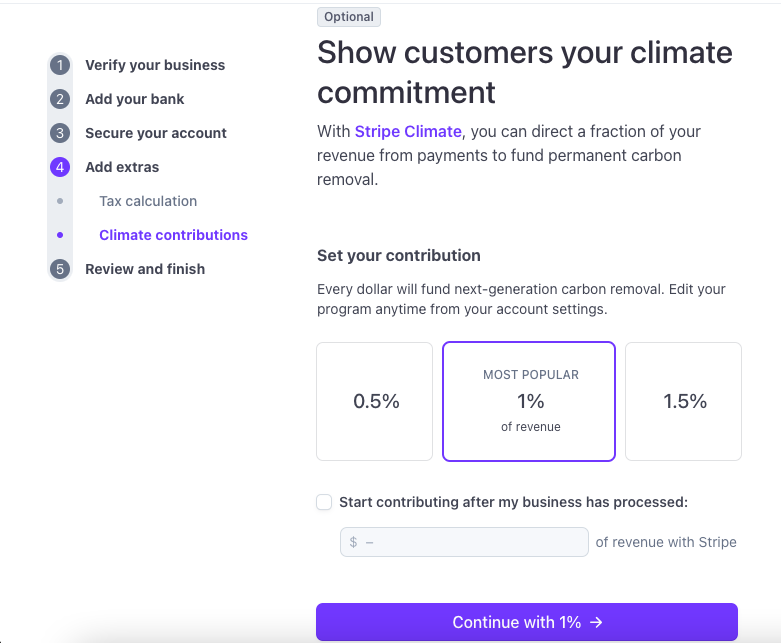

- Explore Stripe’s customization options to tailor the donation experience to match your organization’s branding. For example, Stripe offers the option to dedicate a percentage of revenue to reducing carbon emissions.

Pro tip

Jotform offers even more add-ons to help you boost your fundraising efforts, such as options for allowing recurring contributions or adding personalized thank-you messages to donors.

- Before launching your donation page, conduct test donations to ensure everything is functioning correctly (like making sure all links lead to the proper places). Be sure to thoroughly test your custom donation forms as well.

- Embed Stripe’s payment buttons or widgets directly onto your website’s donation pages, enabling donors to contribute without leaving your site. Stripe also allows for mobile donations, with a responsive design that ensures donors can easily make contributions via their mobile devices.

- To enhance your Stripe account’s capabilities, use Jotform’s Stripe integration. This will enable you to offer seamless donation processing through a custom donation form that matches your nonprofit’s branding — allowing you to incorporate your logo, colors, and images.

- Bolster your fundraising efforts by including preset donation amounts in your form or using premade Jotform templates for fundraisers.

Now that you know the ins and outs of Stripe for nonprofits, read on to learn about a few payment processing alternatives you can consider.

Pro tip

You can even create your own no-code donation app with Jotform. Integrate with different payment gateways, show a donation goal progress bar, add pre-set donation amounts, and more.

Which Stripe alternatives could work for your nonprofit

While Stripe is a leader in managing payment methods, there are other payment gateway options available to your nonprofit that you can also integrate with Jotform. Here are a few:

1. PayPal

Compared to other payment processing platforms on the market, Stripe and PayPal accept the widest range of payment methods. More nations offer and accept PayPal than Stripe, with PayPal offering options in more than 200 countries. PayPal is simple to set up, and offers specific features for nonprofits like donation buttons, making it a good option for those who are just starting out or lack the technical expertise to modify their platforms.

2. Square

Square is ideal for individuals, small businesses, and simple online transactions. Unlike Stripe, which requires some technical know-how and customization for users to begin collecting payments, Square offers a free point-of-sale (POS) system and website with Square payment processing automatically built in. The platform’s out-of-the-box capabilities make it a user-friendly tool that’s simple to set up for organizations looking for an all-in-one solution.

3. Authorize.net

Authorize.net works for organizations that only need a payment gateway. They can enable existing accounts to handle online payments, thanks to the platform’s simple interaction with existing merchant accounts. Organizations that require a straightforward integration process and a payment gateway that works with their present setup might consider Authorize.net for its reliable infrastructure and wide network of partners.

How to make digital donations easy

Stripe’s adaptability, security features, and seamless integration capabilities make it an ideal payment solution for nonprofits — empowering organizations to streamline their fundraising efforts and focus on their core missions.

Plus, when nonprofits combine these payment gateways with platforms like Jotform, they can create captivating custom forms that improve donor engagement and ultimately drive greater support for their causes.

By harnessing the power of secure payment gateways like Stripe and powerful form builders like Jotform, nonprofits can pave the way for more efficient, impactful, and successful fundraising campaigns.

Photo by Kindel Media

Send Comment: