Budget Sheets

About Budget Sheets

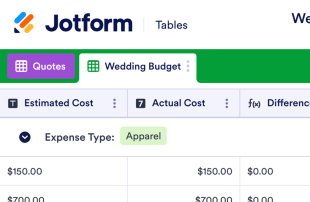

Track your expenses and manage your budget online with Jotform’s free Budget Sheets! Whether you’re managing balances for your business or keeping track of payments at home, expertly manage your budget in a professional online spreadsheet. Start by choosing a template below that most closely matches your needs — then customize it with our user-friendly interface and fill out the attached form to auto-populate your spreadsheet. You can even download your spreadsheets as PDF, CSV, or Excel files or share them with your coworkers or family members online!

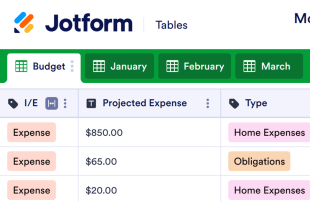

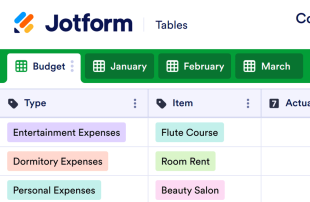

Customizing your chosen Budget Sheet template is easy — in just a couple of clicks you can add new rows and tabs, update label names and colors, rearrange the layout, and choose to view your data in spreadsheet, card, or calendar format. If you’d like to add up totals fast, do it automatically with our quick calculation feature! No matter what kind of budget you’re in charge of, Jotform’s free Budget Sheets make it easier than ever to record payments and manage your amounts on any device.

Frequently Asked Questions

Types of budget sheets

Budget sheets come in a variety of forms that are designed to help you track and manage your finances efficiently. Here are some examples of budget sheets:

- Personal budget sheets: Track individual or household income and expenses, including categories like rent, groceries, utilities, and entertainment.

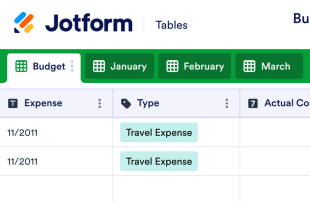

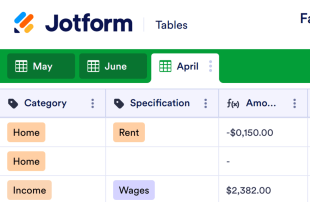

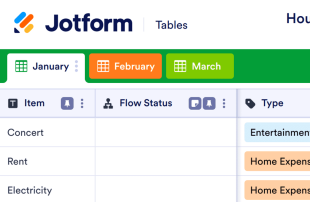

- Monthly budget sheets: Focus on tracking finances on a month-to-month basis, and easily track your regular income and expenses.

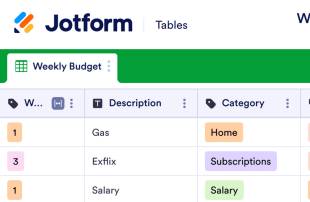

- Weekly budget sheets: Break down finances on a weekly basis if you prefer more frequent tracking.

- Annual budget sheets: Create a yearlong overview of finances for long-term financial planning and tracking yearly income and expenses.

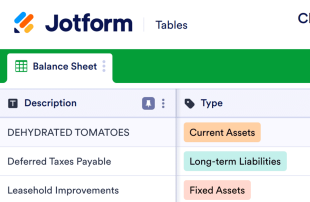

- Business budget sheets: Monitor your business’s revenue, expenses, and profits by tracking categories like operational costs, payroll, and marketing.

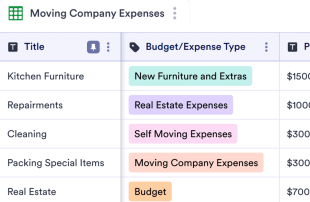

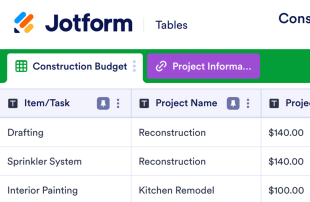

- Project budget sheets: Track all the associated costs for a specific project, such as materials, labor, and overhead, to ensure the project stays within budget.

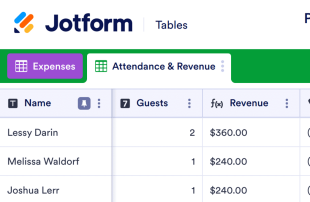

- Event budget sheets: Plan for the expenses associated with hosting an event, like the venue, catering, and entertainment.

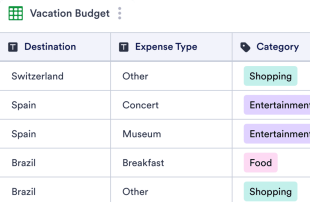

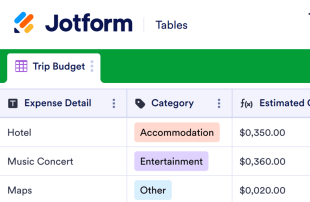

- Travel budget sheets: Help plan and manage expenses for trips, including the cost of transportation, accommodation, food, and activities.

- Debt payoff budget sheets: Track payments and manage strategies to pay down money owed on loans or credit cards.

- Savings goal budget sheets: Plan and monitor progress towards specific savings goals, such as an emergency fund, a new car, or a vacation.

- College budget sheets: Manage the costs of tuition, books, and living expenses while balancing part-time income or student loans.

Importance of budget sheets

Budget sheets are a powerful resource that play a crucial role in financial planning. They offer a clear overview of your earnings and living costs so you can make informed decisions that align with your short-term and long-term financial goals.

Knowing where your money is coming from and where it’s going is key to avoiding debt and building long-term financial security. By laying out your income and expenses in one organized spreadsheet, you can gain a better understanding of your financial situation and make smart choices about your spending, saving, and investing.

Benefits of using budget sheets

More than just tracking numbers, budget sheets are an indispensable tool for gaining control over your financial life. Money can be a significant source of stress, but budget sheets can help alleviate this by eliminating uncertainty about whether you’ll be able to cover your bills or save for the future.

With a budget sheet, you can stay informed about how much money you earn in a given period and how much you spend in different areas of your life. This transparency makes it easier to spot areas where you might be overspending or missing opportunities to save.

Budget sheets also make it easier to plan for the future. Whether you’re saving for a vacation, paying off a loan, or building an emergency fund, you can use a budget sheet to outline a strategy toward achieving your goal and monitor your progress over time.

This helps keep your goals at the front of your mind so you can stay motivated and on track as you work toward making them a reality.

Life is full of surprises, and your financial situation can change suddenly. Budget sheets allow you to respond to these changes quickly. If your income fluctuates, or if you face unexpected expenses, you can use your budget sheet to make adjustments and keep your financial plans on track.

Now, instead of worrying about money, you can focus on following your budget and enjoy peace of mind knowing that you have a plan in place.

Budget sheet use cases

Budget sheets are versatile tools that can be used in a variety of scenarios. Whether you’re managing your personal finances, running a business, or planning a special event, your budget sheet can act as a roadmap to help you anticipate your needs and keep you on track financially.

Individuals can use budget sheets to manage household expenses, maximize savings, and plan for big purchases. Jotform’s personal budget sheet templates make it easy to track your bills and due dates so you never miss a payment.

Use a budget sheet to monitor your daily or weekly spending so you keep your finances in check between paydays. You can also use it as a planner to help you strategize ways to efficiently pay off debt for things like credit cards or student loans.

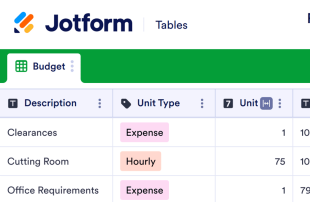

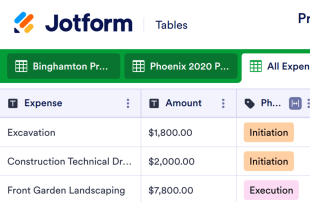

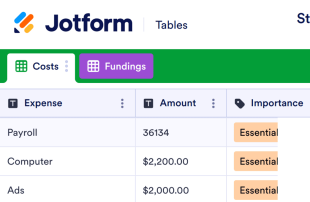

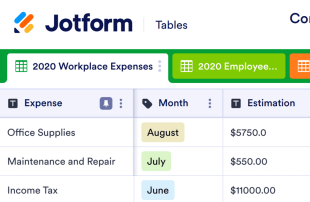

Businesses can use budget sheets to monitor operating costs, forecast revenue, and maximize margins. Create an expense sheet to track how much your business spent on different categories, like payroll, utilities, and supplies.

Track your sales volume and monitor your progress toward reaching your revenue goals for the week, month, and year. This allows you to easily track fluctuations and identify patterns so you can better allocate resources.

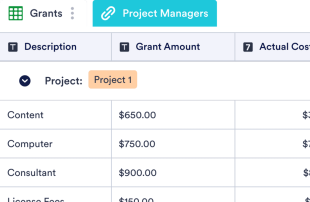

Budget sheets are also an invaluable resource for managing project expenses. You can use a budget sheet to break down costs and allocate amounts to different tasks or phases. This ensures that each part of the project has the necessary funds and helps prevent overspending in any one area.

Once the project is underway, you can use a budget sheet to record the final totals and compare them to your initial cost estimates to easily identify where you might be going over budget. For projects with suppliers or contracts, you can also use your budget sheet to track payments and maintain a healthy cash flow throughout the project.

How to create a budget sheet

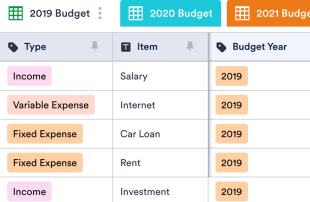

Creating a budget sheet is straightforward with Jotform. You can select one of Jotform’s free, fully customizable budget sheet templates as your starting point, build your own budget sheet from scratch, or convert an existing CSV or XLSX file.

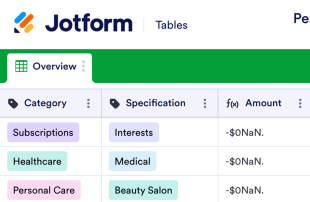

Jotform’s intuitive online builder makes it easy to add, remove, and modify columns to fit your needs. You can calculate your budget by recording any earnings you receive during the period you are budgeting for, as well as your expenses.

Start by inputting fixed expenses that remain the same every billing cycle, like rent or insurance, then add the variable amounts you spend on expenses like groceries or utilities as you go. It’s easy to add data to your table by simply filling out a connected form or manually inputting data directly into the table.

Create custom labels to track different spending categories, and easily add formulas to make calculations automatically. You can quickly analyze your table data with automatically generated charts and download reports as custom PDFs for your records.